Water Affordability: A Growing Challenge

Water affordability is a growing issue in the Great Lakes region and across the nation. In northeastern Illinois, the average water rate grew by almost 80% over the past decade (2008-2018) and water bill growth is outpacing income growth in 78% of communities.

Water Affordability is a function of the interaction between two factors: cost of service (the water rate and the customer’s water bill) and income (the customers’ ability to pay for the service). Water Bill Burden is a ratio based on the percentage of a household’s income that goes toward paying water bills.

Why are water costs going up? Part of the reason is that our water infrastructure, built over a century ago, has aged and urgently needs repair and replacement. Today, almost all water utility customers pay a rate to provide funding for this necessary water infrastructure, driving up the cost of water service. As water costs rise, income growth has remained essentially stagnant — particularly working-class wages. With this income imbalance, lower-income households face significant financial burden with bill increases and mounting levels of water debt. These factors put significant strain on households and on water utility departments facing rising costs to operate water systems.

Elevate’s Work on Water Affordability

In 2019, Elevate, the Metropolitan Planning Council (MPC), and the Illinois-Indiana Sea Grant (IISG) published a report and accompanying dashboard tool that examined water affordability issues in northeastern Illinois. We found that many communities throughout the region are experiencing a high-water bill burden, meaning a significant portion of a household’s income (more than 4.5%) goes toward paying combined water and sewer costs. We also found that water bill burden is not experienced equally across the region. In fact, municipalities with a majority of residents of color had a higher percentage of areas experiencing water bill burden as compared to those with a majority of white residents.

Stemming from this research, in 2020, Elevate and MPC conducted an analysis for the City of Chicago to further research the specific scale and scope of water affordability challenges for its residents. The research team used five years of water bill data, along with interviews with residents and community advocates, to better understand affordability challenges and the lived experience of water stress that many residents face.

Water Affordability in Chicago

The Chicago Water Affordability Analysis found that water bill burden and debt is significant in Chicago and that residents who struggle to afford their water bill also struggle to afford other necessities. Chicago’s lowest income households are the most burdened and pay on average almost 10% of their income on their water bill.

Key findings from the analysis include:

- Water debt carries significant weight when discussing affordability in Chicago. Unpaid balances accrue over time, and payment arrangements are mostly insufficient to address nonpayment.

- Water affordability is not an issue confined to single-family homes. Multifamily buildings, particularly two-unit buildings, have the highest rates of bill nonpayment and the highest levels of water debt over time.

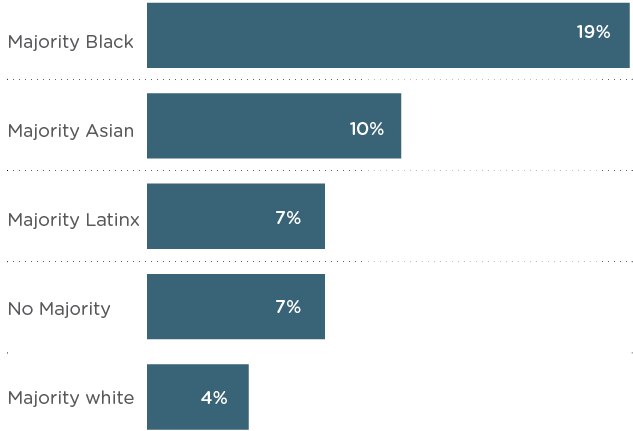

- Water burden in Chicago is not evenly distributed. Census tracts with a majority Black, Hispanic, and/or Asian population face on average a higher water burden while using comparatively less water than accounts in majority white tracts. Notably, census tracts with a majority Black population pay on average 19% of their income on water bills.

Average % annual income spent on water service for Chicago’s lowest income quintile census tracts, 2019

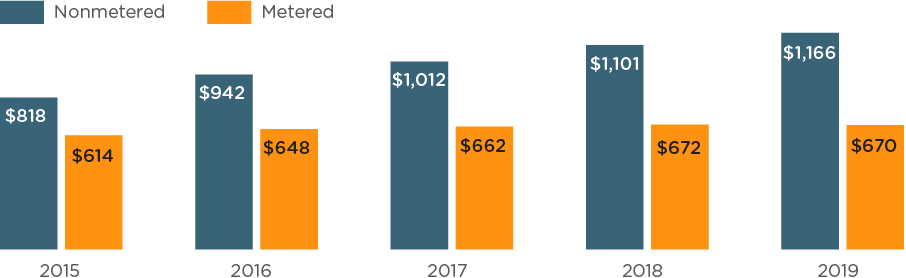

- Residential customers without a water meter pay significantly more for their water bill than customers with meters. In 2019, nonmetered customers in Chicago paid on average $500 more for water than metered customers. These nonmetered customers also have higher water debt and water bill burden.

Average Chicago residential water bills for nonmetered and metered single-family customers, 2015-2019

By sharing its water billing data for analysis, the City of Chicago has taken an important step towards learning about its unique affordability challenges and potential solutions. This step forward also builds on other initiatives at the City that are starting to tackle the water service and affordability challenges, including the Utility Billing Relief program and the moratorium on water shutoffs.

Dealing with High Water Bills and Water Debt?

With more research around water affordability, more cities and states are taking action to address the water affordability challenges that their residents face. Regional assistance programs include:

- Illinois’s low-income household water assistance program (LIHWAP) is designed to help households that are facing the threat of water disconnection or have past due water balances of $250 or more.

- Chicago’s Utility Billing Relief (UBR) program addresses past water debt by providing a 50% rate reduction on water, sewer, and water-sewer taxes, (eligibility is the same as for LIHEAP).

- The City of Evanston offers a reduced water and sewer rate for income-qualified Evanston residents. All Evanston community members who qualify for LIHEAP can participate even if they don’t pay a water or sewer bill.

We encourage more cities to be transparent with their water billing data to inform themselves and the community about water affordability challenges and drive new solutions.

Learn More

Want to learn more about our water affordability work? Read the full Chicago Water Affordability Analysis, and stay up to date with our latest news by subscribing to our newsletter.